Venture Capital

Leading venture capital specialist

Octopus is home to one of Europe’s largest venture capital teams, with £1.9 billion of funds under management (at 30 September 2023), and a strong track record of backing successful entrepreneurs in global markets.

The world of business is rapidly changing. High growth small businesses are disrupting markets at an astonishing pace. We provide investors access to potential returns from some of the world’s fastest-growing businesses, all with the potential to transform the industries they’re in.

Our approach

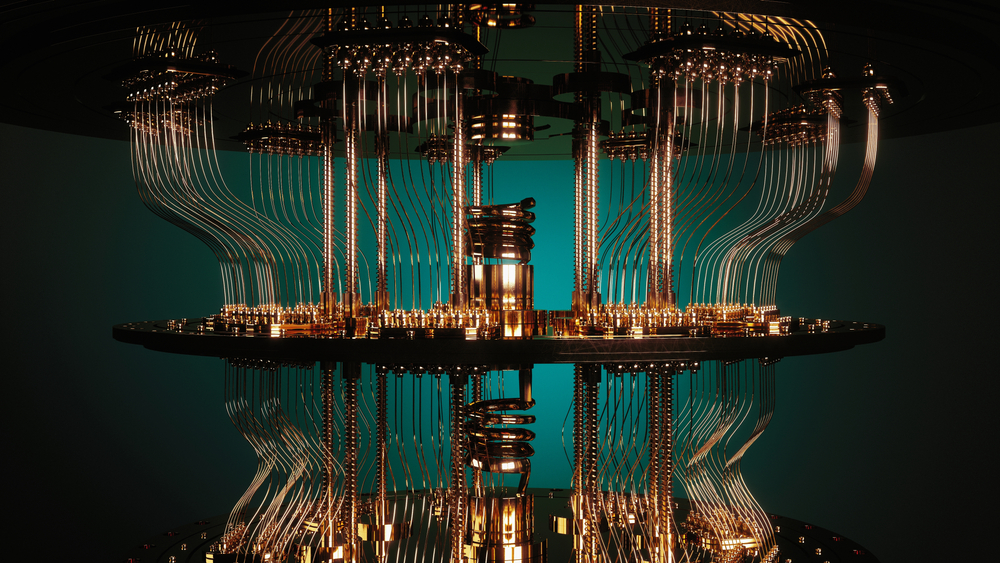

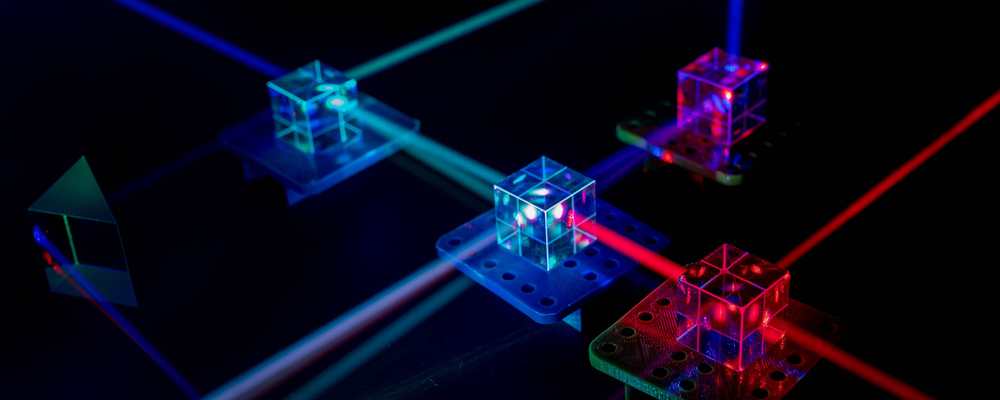

Octopus Ventures backs pioneering unusually talented entrepreneurs daring to reimagine the future of B2B software, climate tech, consumer tech, deep tech, fintech and health, and supports them as they grow from early-revenue to exit.

To date we have backed the founding teams of nearly 200 companies including Zoopla, Secret Escapes, Elvie, Depop, Sofar Sounds and Cazoo. Some of our portfolio companies have gone on to join forces with the world’s largest businesses including Google, Amazon, Microsoft and Twitter.

The Octopus Ventures team is based in London with venture partners in San Francisco, Singapore and China. The companies we back become a part of this network, with access to a formidable resource of experience and expertise.

Our reputation for being transparent, fair and entrepreneur-friendly gives us access to the best investment opportunities. Over time, this has created a virtuous circle where the best management teams repeatedly return to Octopus for funding.

Insights

Unlocking Potential: How investing in deep tech can help to address regional inequality

Maximising UK regional potential with deep tech

TikTok, tagine powder and femtech

The outlook for European Venture Capital: At the precipice or the inflection point?

Why we’re excited about European VC Secondaries

Holding onto hope: how innovation can solve the climate crisis

International Women’s Day: What makes a great female founder?

Behind the B – our one-year anniversary

Fuelling the transition: how investors can accelerate the shift to sustainable energy

Where are the opportunities in growth capital?

Nothing ventured, nothing gained

Why ESG investing is more relevant than ever before

In the news

Other investment capabilities

Renewable Energy Investment

Sustainable Infrastructure

Interested in Venture Capital?

Talk to one of us.

If you are interested in investing into venture capital, or other alternative investments, we would love to hear from you. Please fill out the form below and we will be in touch shortly to arrange a time for further discussion.