Octopus Capital

Unlocking private capital to solve the world’s greatest challenges

Investing with purpose

Like many Octopus brands, Octopus Capital was born out of a collective desire to solve the world’s greatest challenges through innovation and excellent client service. Backed by our heritage in pioneering new investment classes, we are building a world-leading purpose-driven asset management business, aligned to the contemporary priorities of institutional investors.

We support our clients’ investment objectives with impact-focused strategies across multiple asset classes, leveraging our solution-centric, collaborative operating model.

Investments

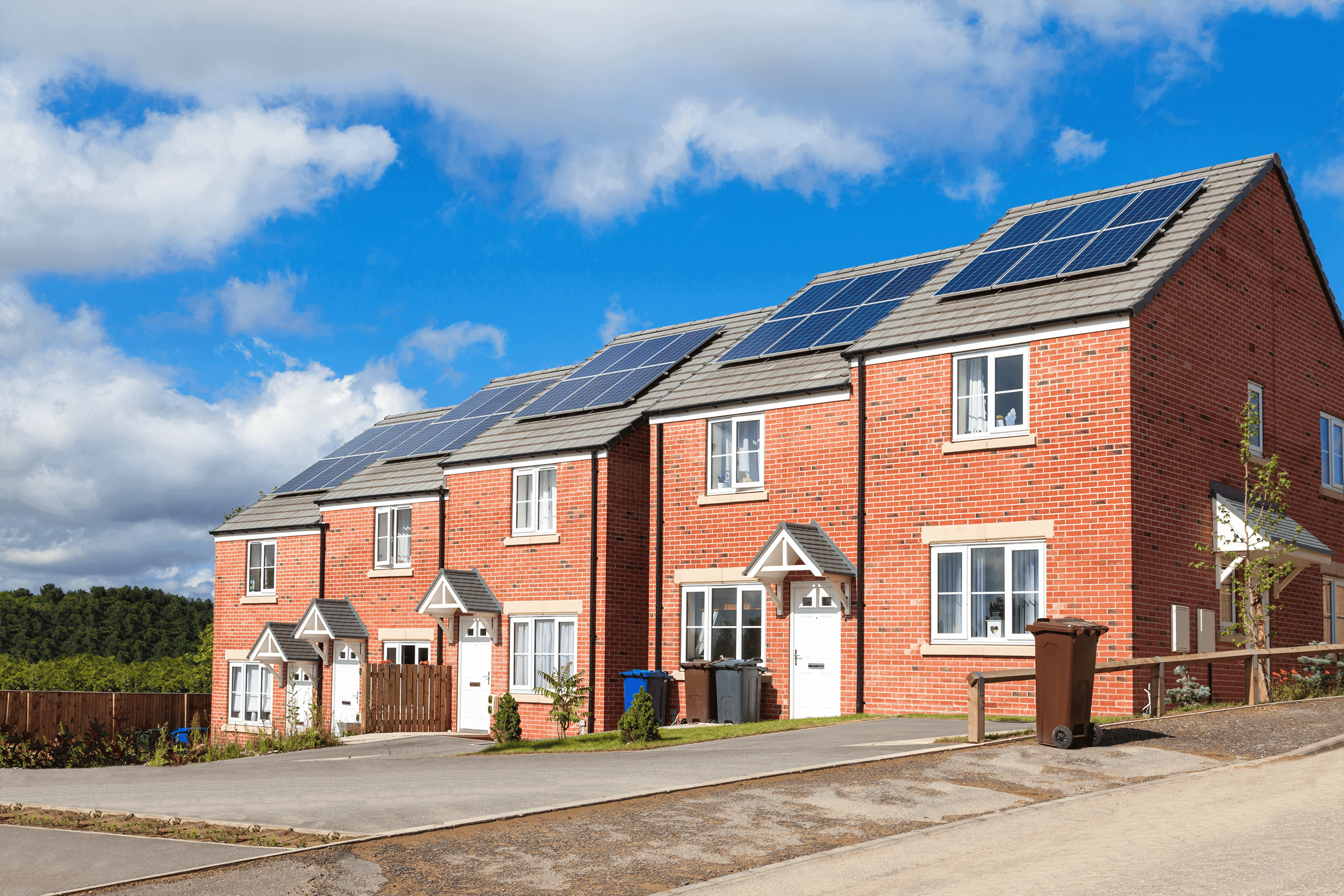

Real Estate

At Octopus, we’re committed to reimaging real estate investment. From seeing opportunities to bring institutional capital to emerging or underserved sectors, to our relentless focus on those living in the buildings we finance and manage.

Natural Capital

Octopus Capital’s natural capital strategy focusses on generating trustworthy carbon credits through our robust investment management and high quality conservation.

Sustainable Infrastructure

We are investing in sustainable infrastructure, helping drive the transition to net zero.

Ventures

Octopus is home to one of Europe’s largest venture capital teams. We back early stage companies run by the world’s brightest minds.

Read our latest report – Net Zero: The Second Stage

UK businesses are making progress towards net zero, but there’s still a long way to go. We surveyed over 300 UK business leaders to identify the biggest challenges and explore how nature can help rebuild confidence in the carbon credit market.

Insights

CHP partners with NewArch Homes to deliver 220 affordable homes across Essex

Octopus and Homes England launch £150m Greener Homes Alliance 2

Octopus completes transfer of 44 affordable homes in Pinhoe, Exeter

Investing in affordable homes for the long-term

Meeting the demand for senior living in Europe

In the news

Proud to be a B Corp

We’re thrilled to be one of the UK’s first financial services companies to meet the strict criteria to become a B Corp. To gain B Corp certification, a company needs to meet high standards and prove it has a positive impact not just on its workers and customers, but also on the wider community and environment.

We are fully committed to Responsible Investment:

It’s key to who we are and how we invest. We make bold commitments with transparent reporting.