Many of us will remember 15 September 2008 – the day Lehman Brothers collapsed. Those who do not are likely to have seen it immortalised in film or television, or read about it in books and magazines. It’s a day we’ve come to associate with financial collapse. So, it’s perhaps hard to imagine it being the day of a successful business launch. Yet that’s what it was for graze.com. And less than a year later, Octopus would be backing the business.

This, after all, is what we do. We invest in the ideas that we believe in and the people with the persistence to realise and grow them. Over the next five years, Octopus Ventures expects to deploy around £200 million annually into early-stage businesses that have the potential to disrupt existing markets on a global scale. We expect that some of them will go on to join the ranks of Zoopla, Cazoo, Bought By Many and Depop as businesses we’ve backed that have grown to become so-called unicorns – businesses with a valuation of more than £1 billion.

Investing in growth businesses is one of the longest-standing parts of Octopus. It’s this part, these stories, that I’d like to share with you today. In recent months, the Octopus Ventures team, led by Alliott Cole and Emma Davies, has enjoyed a dazzling run of success, with portfolio company exits and valuations that reflect the explosive growth potential of the businesses we back. We pick five here that we’re proud to highlight.

Invested capital is placed at risk . The value of an investment may fall as well as rise and investors may not get back the full amount invested. Shares in early-stage companies could fall or rise in value more than other shares in more established companies. They may also be harder to sell. Past performance figures of any investment are provided for illustrative purposes and are not indicative of future results. The performance of any investment will vary and fluctuate over the period that the investment is held.

Calastone: modernising mutual funds

Another 2008 story for us was investing in global funds network Calastone at seed stage, following up with multiple rounds of funding. With a mission to make funds accessible to all, Calastone was started because its founders wanted to address the inefficiencies of the fund industry through digital connectivity and transformation. The primary objective of the business has been to reduce the cost and risk associated with the processing of mutual fund transactions. Using technological innovation – including blockchain – Calastone offers a fully automated digital marketplace that operates in (near) real time. The business has grown to be the world’s largest global fund network, processing over £200 billion of investment value each month. For us, it’s a story that has shown the value of fostering long-term relationships. It was one of our very first investments (with the Octopus Titan Venture Capital Trust), and we sold our holdings in Calastone at the end of 2020 to The Carlyle Group for £340 million.

Cazoo: used-car unicorn

Though a more recent choice for Octopus, our investment in Cazoo – the ‘Amazon’ of the used-car market – was also one that came out of a relationship we’ve had since our own inception. When Alex Chesterman, whose companies LoveFilm and Zoopla we’d previously invested in, reached out at the end of 2018 with another opportunity, we were interested. Besides the business opportunity, we were backing Alex and a relationship that spans more than a decade (interestingly, we invested in Zoopla only a couple of weeks after Lehman’s collapse). Like many of Alex’s companies, Cazoo is customer-focused and data-driven, offering the UK market a platform for ordering a car entirely online – from researching and viewing to financing and trading – with delivery in as little as 72 hours. It’s one of Europe’s fastest-growing digital businesses, with growth of more than 300% year on year. Following a merger with a US investment vehicle, at a valuation of $7 billion, it’s now set to list in the US. It’s a perfect example of how this side of the Atlantic is producing tech leaders – just where we want to be.

Bought By Many: prioritising your pets

Like all the businesses we back, Bought By Many puts technology at the core of its business. It was the first UK pet insurer to offer a wholly form-free claims process for its customers, who voted it ‘Best Pet Insurance Provider’ in the 2020 Insurance Choice Awards. Currently, only a quarter of pet owners in the UK have cover for their furry loved ones, but we believe it’s a market ripe for investment, with people spending nearly £8 billion on their pets in the UK alone last year. The company has been performing well, doubling its gross written premium for three consecutive years to a figure that topped $220m in its most recent financial year. With its latest raise, in which we participated, Bought By Many now has a pre-money valuation of over $2 billion.

WaveOptics: snapped up by Snap

If you’re a fan of 80s films, then I’m sure you can picture the chunky JVC glasses Marty wears in Back to the Future 2. We might now be a few years beyond 2015 (the point in time to which Marty travels in the film), but WaveOptics is closer to making that scene a reality. Though head-worn augmented reality (AR) is used in defence, industry and medicine, we’re not yet using these devices in our everyday lives. But deep-tech start-up WaveOptics is looking to change that, developing its waveguide and light-engine technologies to make AR devices lighter and wearable enough to go mainstream. We co-led the Series A investment in 2015, investing further in 2017, 2018 and 2020. The business has been successfully growing since: in 2020, WaveOptics delivered £6.5 million in net revenue, a growth of over 300% year on year. In 2017, David Hayes joined as CEO, recognising the market-readiness of the product and transforming the company from a R&D business to a product one. The transformation has borne fruit. Just a month ago, US-based Snap, which WaveOptics supplies with displays for its AR ‘Snap Spectacles’, bought the Oxfordshire-based firm for over $500 million in a cash-and-stock deal.

Depop: selling on, not selling out

A social network meets marketplace, Depop positions itself as community-led and kinder – for people and for the planet. In fashion, Depop has successfully tapped the Gen Z market: not an easy demographic to get on side. But it hasn’t done this with fancy marketing campaigns designed to sell you what you don’t need. Instead, 80–90% of Depop’s audience acquisitions have been organic: friends recruiting friends. This word-of-mouth approach has also seen influencers and celebrities embrace the platform (even Lily Allen has a store), which made £50 million in net revenue last year, growth of 140% year on year. The mobile-first marketplace has attracted the attention of US e‑commerce company Etsy, which is now buying Depop for $1.6 billion – perhaps not surprisingly, considering how popular the London-based app is in the US among Gen Z consumers. As Etsy looks to expand its user base by lowering their average age, Depop is the perfect business for it to have acquired.

Opportunities are always out there

If our experience has taught us anything, it’s the value of long-standing relationships, the importance of persistence and the utility of inquisitiveness. It has also taught us not to freeze, even when the rest of the market might. The global financial crisis didn’t stop us investing. Since 2008, we have backed over 130 teams, some of whom have gone on to join forces with the world’s largest businesses, including Google, Amazon, Microsoft and Twitter.

Nor were we put off by the pandemic. Even in the midst of the Covid outbreak in 2020, the European tech sector saw $40 billion in investment, with this rising again in 2021. Indeed, Europe has produced more tech IPOs than the US every year since 2016.

Our team will continue to invest in the five areas where we see the most potential for growth and innovation:

- Health, helping the pioneers who are improving lives through digital health and creating essential software to power health systems.

- Fintech, exploring novel finance and insurance products with entrepreneurs who want to change the face of money globally.

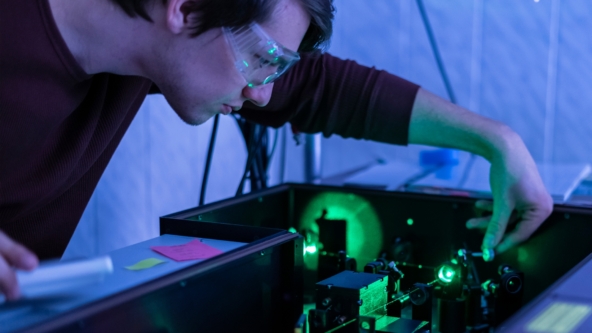

- Deep tech, focusing on the tools and innovations that will power the next industrial revolution.

- Consumer, backing the innovators who influence the way we live, work, travel, play, rest and recuperate.

- B2B Software, investing in companies driving digitalisation and automation across traditional and nascent industries

As always, our mission at Octopus is simple. We invest in the people, the ideas and the industries that will help change the world. And we think we’ve been doing a pretty good job of it so far.

Octopus Ventures offers established institutional fund and deal-by-deal investments. If you represent an institutional or family office investor that is interested in growing its allocation to venture capital now or in the future, please get in touch to request more information.

Personal opinions may change and should not be seen as advice or a recommendation. We do not offer investment or tax advice. Issued by Octopus Investments Limited, which is authorised and regulated by the Financial Conduct Authority. Registered office: 33 Holborn, London, EC1N 2HT. Registered in England and Wales No. 03942880. Issued: July 2021.

Resources

https://octopusgroup.com/newsroom/latest-news/octopus-ventures-exits-its-investment-in-calastone/

https://octopusventures.com/insights/latest-insights/alex-chesterman-the-archetypal-unicorn-builder/

Insights

Unlocking Potential: How investing in deep tech can help to address regional inequality

Maximising UK regional potential with deep tech