The Climate Crisis is one of the world’s biggest collective problems to date. Fixing it requires a simple, clear, and decisive strategy. The team at Octopus Ventures are focused on backing innovation and embracing collaboration because we believe with the right support, individuals and organisations have the power to solve this crisis.

“To avert irreversible, catastrophic consequences, we need to act urgently and decisively.” John Doerr (Speed & Scale: A Global Action Plan for Solving Our Climate Crisis Now).

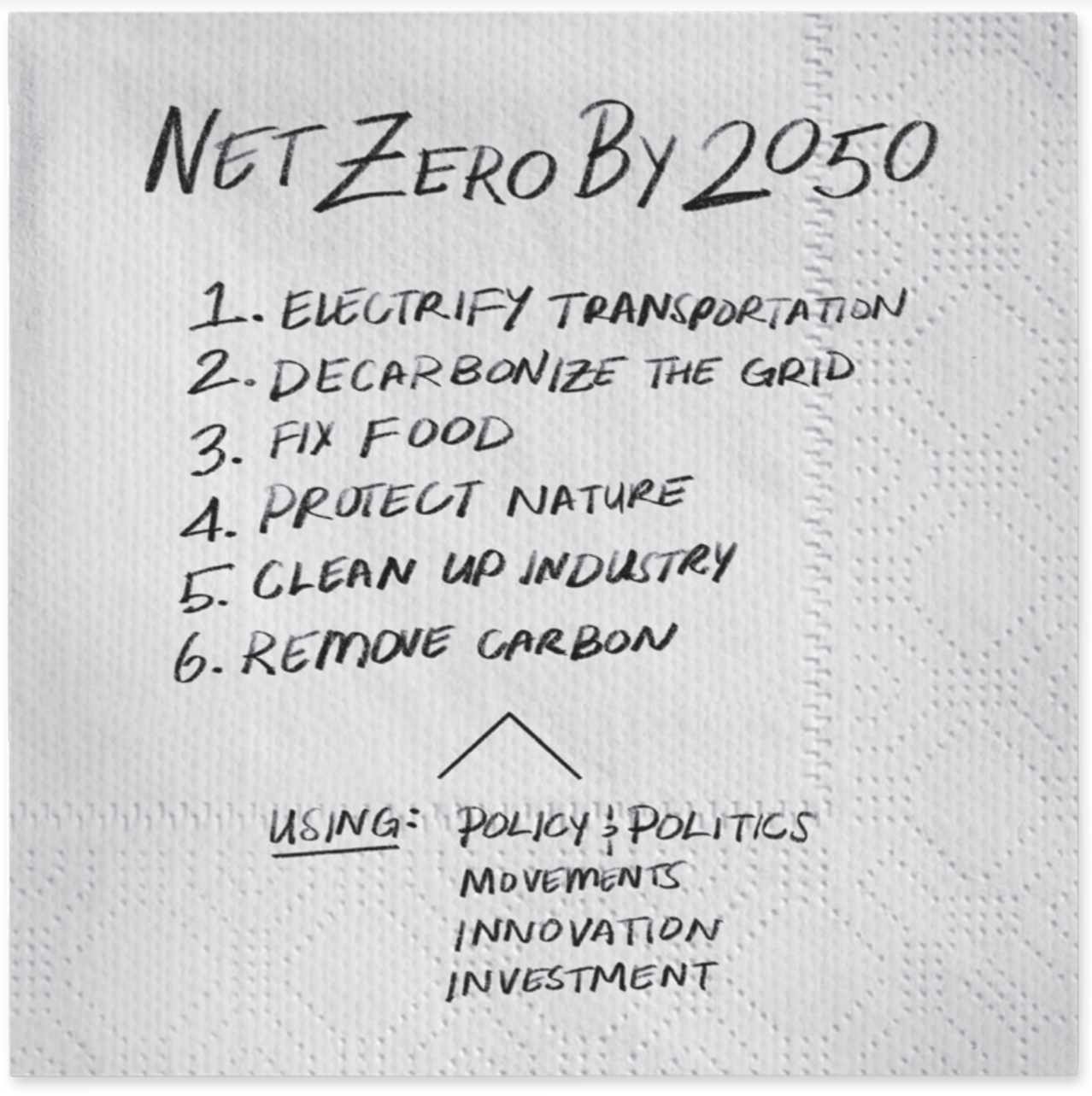

Doerr, a renowned venture capitalist, takes his inspiration from Franklin D. Roosevelt who presented his three-point plan to win World War II on a cocktail napkin. When someone tells Doerr something is too complex, he asks them: “Is the problem you’re trying to solve really more complicated than WWII?”

Doerr built his case for an actionable climate change plan over more than 400 pages and condenses these thoughts into the words written below; onto a sketch roughly the same size of a napkin. It’s an excellent example of communicating complex information clearly, simply, and visually.

We are inspired by this outlook. Venture capital looks for big opportunities that provide solutions to big challenges. We recognise our impact can be two-fold. We can invest in the companies solving for climate change and simultaneously, we can share best sustainable practice as we learn from and with our investee companies.

Climate Investment

The problem is enormous. The world’s greenhouse gas emissions amount to approximately 59 gigatons of CO2e per year¹. According to Supercritical, we must remove 8 billion tons of CO2 a year by 2050 to stay below 1.5 degrees of warming². These figures amplify the need for better policy and greater investment. We need government grants and support from institutional investors, but we also need innovation. Sourcing carbon removal technologies at scale requires knowledge, expertise, and early-stage investment capital.

Octopus Ventures holds expertise in climate verticals such as energy and efficiency (Origami Energy) and climate data (Minimum). We also back founders who think about food waste (Olio), fast fashion (Depop) and those who are reimagining the way we travel (Trafi).

We partner with mission-driven founders who are motivated by driving change and enabling positive outcomes. We want to invest in innovative technologies that will disrupt our today and create real climate change impact. We recognise the road ahead to 2050 is not easy. We constantly challenge each other to develop the knowledge that will be needed to move the needle when it comes to climate change. And what makes it easier is we are a part of an ecosystem of investors, pioneering companies and climate leaders lobbying for the same result. We are looking to strengthen ties with likeminded institutions who recognise the need to collaborate and amplify our efforts.

As Doerr aptly states: “If you are scared into action, then I have done my job. But for our fear to work for us, it needs to galvanize, not paralyze. To spur us on, it must be tethered to hope.”

We feel Ventures is perfectly placed to champion this hopeful sentiment. The opportunities which come across our desks daily are impressive. Our capital can unlock the technologies and back the people with the solutions to the crisis and it is our privilege and obligation to help them scale.

Best Practice

Octopus is very proud to be a certified B Corp³. Being a B Corp means we take into consideration every single one of our stakeholders when making decisions: our employees, customers, environment, community, and shareholders. We believe that the most valuable companies in the future will be those that not only solve society’s biggest problems, but that also behave in a way that is reassuringly human.

We have also signed up to the B Corp Climate Collective joining 1700+ other companies to commit to reaching Net Zero by 2030⁴. Championing these values means we must also ensure they exist in our investment DNA and support our portfolio companies in embedding them too.

We are always driven forward by what our portfolio companies need. In our annual data questionnaire, we asked our companies a simple question: “Do you measure your carbon footprint?” Unsurprisingly, most companies said not yet. But they also let us know that they cared very much about how their corporate activity would impact the environment. This helped us to understand where we could lean in and add value.

Based on our findings, we’ve started by partnering with Minimum, a carbon accounting tool, with the aim of helping ourselves as well as every company that we have invested in. Put simply, you cannot drive change without knowing where you are in the first place. By providing our portfolio with a simple yet effective carbon measurement tool, we hope we will help our investee companies build the best foundation when it comes to sustainable thinking and decision making. We will also be able to learn a huge amount from the aggregated data generated from the entire Octopus Ventures’ ecosystem, which will enable us to define what good looks like at the different stages of a company’s evolution and to share best practices within our community.

An opportunity to help solve the crisis

The Climate Crisis is hugely complex. Action on this cannot be unilateral. The problem is bigger than any one organisation and solving it will require businesses, governments, and individuals around the world to work in harmony. We recognise we are in a privileged position. At Octopus Ventures, we have an opportunity to invest in innovative technologies as well as track what’s being done across our portfolio and share best practice.

The scale of the problem might be daunting, but that doesn’t mean it’s insurmountable. We back innovation, embrace collaboration and foster hope, because we think with the right support, individuals and organisations have the power to solve this crisis.

Useful insights

Discover our Future Generations Report

Our Future Generations Report is our inaugural ‘impact’ report, tying together everything we do across the Octopus Group.

Octopus Vision

Find out what Octopus are doing to have a positive impact on our planet and its people.

Venture Capital Capability

Octopus is home to one of Europe’s largest venture capital teams. We back early stage companies run by the world’s brightest minds.

Unlocking Potential: How investing in deep tech can help to address regional inequality

Maximising UK regional potential with deep tech

TikTok, tagine powder and femtech

¹Emissions Gap Report 2020 – UNEP

²What is carbon removal? – Supercritical

⁴Net Zero 2030 – B Corp Climate Collective