Sustainable Infrastructure Investment

We are investing in sustainable infrastructure, helping drive the transition to net zero.

A new wave of sustainable infrastructure is emerging

The UK has already made significant steps towards it’s climate goals – for example, solar and wind assets are now mature sectors. However, this is only a part of the solution in reaching net zero.

Meeting net-zero targets will require billions of pounds of investment to scale up new emerging infrastructure assets across critical sectors. The opportunity is ripe for progressive companies to shape and grow these emerging sectors, supported by private growth capital.

New sectors need to scale up

Reaching net zero will require a new breed of asset classes, including long-duration electricity storage, hydrogen, electric vehicle charging, carbon capture, battery recycling and other ways of tapping into renewable resources and recycling finite resources.

Existing sectors need to adapt

We also need to set new, higher benchmarks for existing sectors. For example, we need to decarbonise our heating, industrial processes and construction industry, dramatically improve the energy efficiency of expanding digital infrastructure and make sure that we improve and scale recycling processes and technologies.

Society is at an inflection point

Our approach

Our team have a combined 70+ years of experience working on infrastructure investments. We are experts in backing asset-intensive platforms in critical emerging sections with truly transformative potential, and scaling them up.

As hands-on managers, we are actively involved in the key operational, commercial and financial aspects of each asset. This is critical for emerging infrastructure which requires more proactive asset management.

We have committed approximately £1 billion into our strategy and continue expanding by working with companies looking for growth capital.

Sectors we invest in

Circular economy

- Recycling

- Waste management

- Supply chain

Energy transition

- Energy storage

- Power and heat networks

- Energy efficiency

- Hydrogen and carbon capture

Future mobility

- EV Charging

- Clean fuel

- Clean transport

- Clean equipment

Digital infrastructure

- Green data centres

- Edge computing

- Network densification

“The transition to net zero and a more digitally connected world presents an exciting range of new investment opportunities. By supporting the next generation of sustainable infrastructure businesses, we can help them build the foundations of the UK’s future economy, while targeting suitable risk-adjusted returns for investors.”

Rob Skinner, Head of Sustainable Infrastructure

Our team

Rob Skinner

Sean McLachlan

Lukasz Michalak

Portfolio companies

Insights

Sustainable Infrastructure: Going Beyond Renewables

Unlocking the UK’s regional potential by building a new generation of sustainable infrastructure

The road to zero-emission transport in the UK

From the White House to the EU: How the world is driving green investing

Paving the way to a more sustainable future

The new venture shaking up the construction of sustainable infrastructure

Investing in today’s Thomas Edisons

Devon goes cyber with fibre: How Octopus delivered full fibre to a rural village

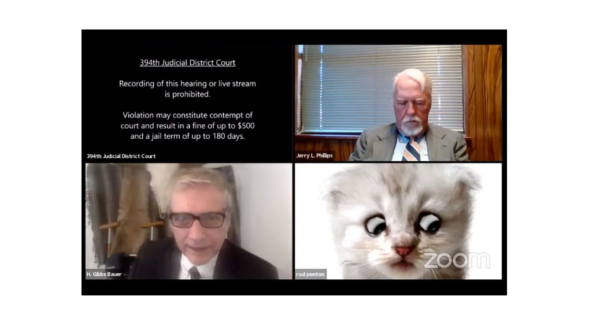

‘Judge, I am not a cat!’

Upgrading the UK’s digital infrastructure

In the news

Interested in Sustainable Infrastructure?

Talk to one of us.

If you are interested in investing into sustainable infrastructure, or other alternative investments, we would love to hear from you. Please fill out the form below and we will be in touch shortly to arrange a time for further discussion.

Other investment capabilities

Natural Capital Investment

Renewable Energy Investment