The UK’s regional inequality challenge should be considered critical and opportune. By unlocking the potential within our communities and harnessing the power of our universities, we can level up the UK and create a more equitable and sustainable future.

Investing in deep tech provides institutional capital with the means to have a tangible impact, generating financial returns while fostering positive social change.

Regional inequality in the UK is a growing problem

Regional inequality in the UK is a growing problem, with the country exhibiting the highest income inequality among major European economies.

Disturbingly, our disposable income divide is larger than any comparable country and has increased over the past 10 years. Official government data from 2017 found it to be £16,000 per head in the North-East and £28,000 in London.1

To truly address these critical issues and level up the UK, we must look to maximise the potential that already exists within our communities: our universities.

Universities facilitate the creation of frontier breakthrough technologies with the potential to impact millions and produce an educated and highly skilled workforce. This workforce can support the transition of ideas into companies, promoting early growth.

By investing in deep tech research within our universities, they can become the engine rooms of levelling up.

What exactly is deep tech?

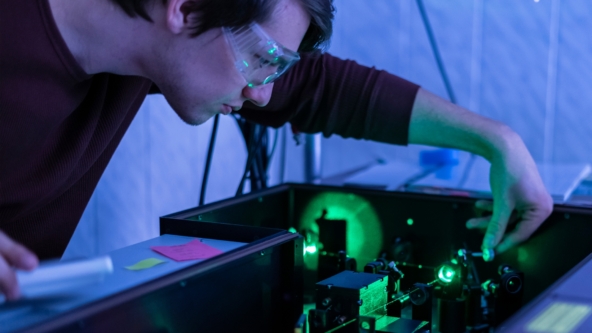

Deep tech encompasses cutting-edge technologies that rely on scientific breakthroughs and engineering innovation. These technologies, created out of years of university-based research, have the potential to revolutionise industries, create jobs, and be developed and implemented anywhere.

Take Exscientia – a company that spun out from the University of Dundee; it is using artificial intelligence (AI) to precision engineer future drugs for patients and revolutionise drug discovery. In 2021, it went public via an IPO, taking the company’s valuation at the time to an impressive €2.5bn.

This is just one illustration of deep tech’s vast possibilities, including quantum computing, robotics, and photonics. These technologies can create entirely new industries and transform existing ones.

How institutional capital can help to unlock this potential

Investment in deep tech allows researchers to build on the intellectual property that they have developed within university research centres to create a growth pathway that results in commercially viable products.

With the right investment in these transformative technologies, they can challenge the status quo. The businesses that emerge will create new markets, generating jobs, and stimulating productivity and economic growth for the long term.

They also have the potential to tackle significant social issues such as climate change and vaccine development.

This presents an interesting opportunity for institutional investors who look to balance deploying money responsibly while helping create a more equitable future aligned with government and social objectives.

And deep tech is a rare occasion where those two aims coincide.

Pre-seed investments provide a flow of capital that can directly improve regional inequality, opening doors to businesses with supernormal growth potential. This investment strategy offers potential for financial returns and portfolio diversification and can help to address societal challenges like levelling up and climate change.

The UK’s regional inequality challenge should be considered critical and opportune. By unlocking the potential within our communities and harnessing the power of our universities, we can level up the UK and create a more equitable and sustainable future.

That’s why Octopus Investments launched our deep tech strategy. It aims to provide the most promising university spinouts with the capital and skills to bring breakthrough technologies to market. This strategy allows institutional capital to have a tangible impact, generating financial returns while fostering positive social change.

1 https://www.ft.com/content/7204c062-1047-11ea-a225-db2f231cfeae