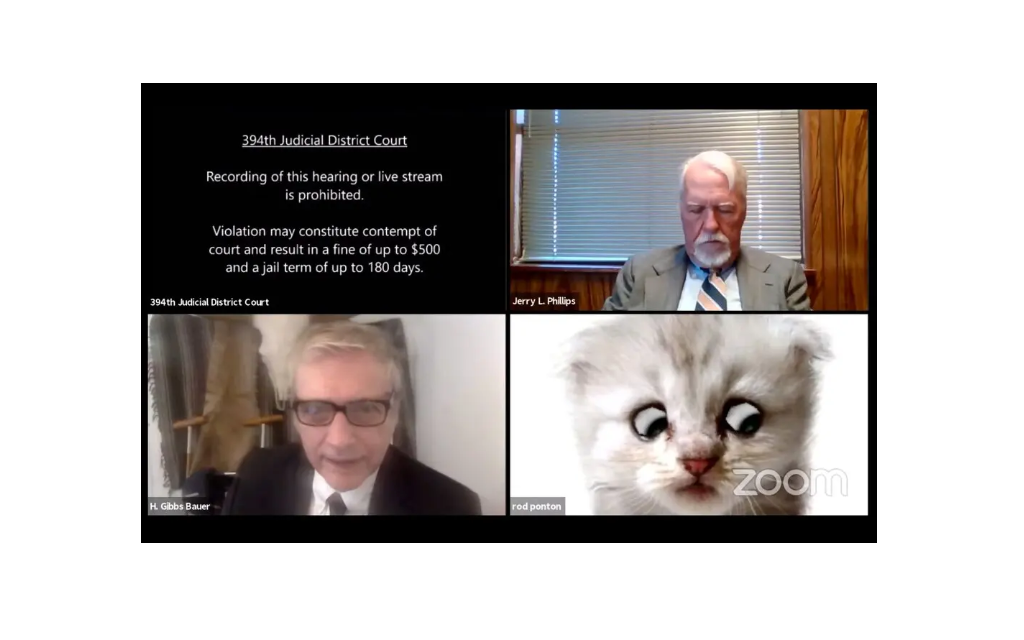

Did we all adapt to lockdown overnight? Were we all video-conferencing experts from March 2020? A certain lawyer in Texas’s 394th Judicial District Court certainly wasn’t… becoming known as the ‘Zoom cat lawyer’ – an instant meme – thanks to his inability to control Zoom’s cat-face filter.

But, like so many of us around the world, the ‘Zoom-cat lawyer’ would have quickly adjusted to a lockdown. More than that, we did things we never thought were possible and we pulled together in ways we would never have imagined – national lockdowns, vaccine rollouts, furlough schemes and business loans. Not to mention the 300 million Zoom calls a day that kept us connected to family, friends and colleagues (a few of whom turned into cats).1

If we can do all that, surely, we can come together and tackle climate change!

Scientists, engineers, entrepreneurs, and investors are already committing their time and capital to the right causes. At Octopus, one of our key priorities is sustainable infrastructure, which is critical for reducing emissions and achieving net zero.

The next frontier for infrastructure

The International Renewable Energy Agency recently projected that achieving the goals of the Paris Agreement by 2050 would require investment of $4.4 trillion per year in low-carbon energy alone.2 Renewable energy already attracts substantial private investment from the biggest institutions in the world and is on the right track to reach its full potential. Renewables are vital if we are to build a better world for future generations – but there’s so much more we can do.

If we are to achieve our environmental targets, we must support other critical sectors to reach to the same level of adoption as renewable energy has over the past ten years. At Octopus, we are constantly talking to entrepreneurs and companies with plans to solve the UK’s infrastructure needs in mobility, digital infrastructure, circular economy and the next wave of energy solutions.

The good news is that these asset classes are based on technologies that have been proven and are becoming commercially viable. But they require financial and operational support to achieve their full potential.

Our role is to identify the best companies within those sectors and support them to reach their full potential.

What will the future look like?

Try to imagine streets full of zero-emission autonomous cars and buses. Many countries, including the UK, are looking to phase out petrol cars and introduce a shared economy. Delivering these initiatives will require a whole new suite of infrastructure asset classes. And we’re not just talking about EV charging points.

We also need energy-efficient digital infrastructure – fibre, wireless antennae and data centres – to support the growing demand for cloud computing. For example, it is estimated that seven robo-taxis will consume as much data as Vodafone Germany’s entire network!3

Unfortunately, data centres are particularly energy-intensive, and their footprint will continue to grow. Therefore, we need to focus on building data centres with ever-improving energy efficiency and power them with clean energy 24 hours per day. That requires renewable energy but also energy-storage solutions.

And then we need the facilities to recycle the batteries and ageing electronics safely. Specialist recycling companies sort through old smartphones, power tools and batteries, separate out the nickel, cobalt and lithium so that they can re-enter the supply chain as components for electric vehicle batteries, among other devices.4 This is a great example of how ideas in the circular economy can facilitate future clean mobility.

How will we get there?

The first step has been made. Renewable energy generation is well established in the UK, widely recognised by private investors, and is on a clear path to achieving its full potential.

The remaining steps are still to be taken – mobility, digital infrastructure, circular economy and complementary energy solutions.

Octopus has a long history of backing entrepreneurs and small companies to reach their lofty ambitions. We have also been at the forefront of the shift to renewable energy in the UK over the past ten years. We are now excited by what the next wave of emerging infrastructure will look like and are keen to help find the companies to deliver this step-change in the UK’s economy and help them succeed.

Insights

Sustainable Infrastructure: Going Beyond Renewables

Unlocking the UK’s regional potential by building a new generation of sustainable infrastructure

The road to zero-emission transport in the UK

From the White House to the EU: How the world is driving green investing

Paving the way to a more sustainable future

The new venture shaking up the construction of sustainable infrastructure

Investing in today’s Thomas Edisons

Devon goes cyber with fibre: How Octopus delivered full fibre to a rural village

Upgrading the UK’s digital infrastructure

1 https://www.matthewwoodward.co.uk/work/zoom-user-statistics/

2 https://www.mckinsey.com/business-functions/operations/our-insights/accelerating-sustainable-infrastructure-an-investors-perspective

3 Credit Suisse European Telecoms Outlook Report – 6 December 2021

4 https://www.ft.com/content/e88e00e3-0a0c-469a-986b-1ffda60b6aee