Across the UK, dormant properties, brownfield land and underused commercial spaces often blight our urban landscape.

Yet, with thoughtful regeneration and strategic investment, these spaces hold the potential to transform into vibrant, income-generating assets that benefit entire communities.

Many developers, however, face barriers to financing these projects. Traditional lenders are often unable to finance transitional assets due to the lack of rental income needed to service bank loans, creating a gap that non-bank lenders, and debt funds in particular, can fill.

This is where Octopus steps in as a catalyst for unlocking real estate value.

By offering tailored, flexible funding solutions – from acquisition loans to development and stabilisation loans – we can enable developers to bring tired, depreciated properties back to life.

Making the most of a missed opportunity

In England alone, over 265,000 homes sit vacant1, while London’s office space vacancy rate reached 7.0% as of November 2024 – the lowest level in 18 months.2

At the same time, the UK faces a pressing challenge: the government’s goal to build 1.5 million new homes over the next five years.3

Regenerating brownfield assets represents a significant opportunity to tackle one of the UK’s biggest societal challenges while reinvigorating communities and driving sustainable growth.

Seizing the moment: Unlocking value at obsolescence

Real estate depreciates over time. Without ongoing investment and refurbishment, many buildings can become outdated within a few decades. Not only do fashions change, but the building fabric depreciates, components fail, and energy efficiency falls short of newer standards.

The effect of obsolescence is often overlooked, even by experienced investors. The impact on financial performance is progressive and can be very expensive to reverse.

However, these assets hold latent value. Investors can add significant value with less planning and construction risk by regenerating and repurposing depreciated buildings instead of building new ones.

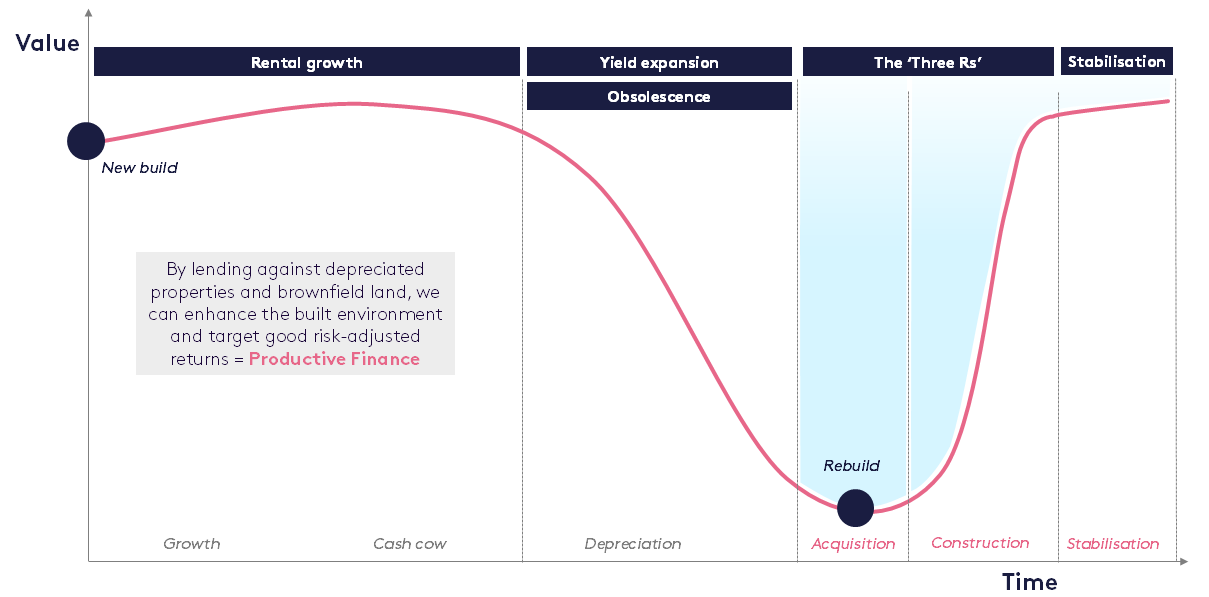

The following graph illustrates the key phases in a typical asset’s life, including rental growth, yield expansion, obsolescence, and redevelopment. It highlights how intervening at the point of maximum obsolescence can generate the most value through repositioning, refurbishment and redevelopment (the ‘three Rs’).

Delivering a positive impact

Transitional real estate debt goes beyond financial returns. By supporting targeted regeneration, it can help drive positive societal outcomes that create lasting value for all stakeholders:

- Breathe new life into run-down properties, transforming them into useful, revenue-generating assets.

- Repurpose buildings instead of demolishing and rebuilding, cutting carbon emissions by up to 70%.4 This approach supports the drive toward net zero whilst enabling retrofitting for improved energy efficiency.

- Provide capital to best-in-class developers, empowering them to align with responsible development practices.

- Create homes, infrastructure, and amenities that enhance community spaces, fostering growth and well-being.

These pillars align closely with our investment philosophy, which prioritises repositioning the ‘3Rs’ as key long-term value drivers.

Bringing regeneration to life

Here are two examples of projects that demonstrate how this strategy can maximise value creation whilst delivering positive environmental impact:

1. Isle of Dogs, East London

A partially vacant office building was transformed into 63 residential units, addressing local housing demand. With the support of a commercial acquisition loan, this property became a vital residential hub, contributing to a broader vision of 10,000 new homes and 110,000 jobs.

Before:

After:

2. York, North Yorkshire

A redundant former gas works, including a decommissioned gas holder, is being transformed into a vibrant mixed-use development. Supported by a commercial acquisition loan, the project covered site acquisition, clean-up, and infrastructure works to prepare the area for redevelopment.

Once completed, the scheme will deliver 625 residential units, 928 beds, retail spaces, and community-use floor space, addressing local housing needs and revitalising the area.

Before:

After:

These case studies illustrate how targeted investment can reposition properties, unlock significant latent value, and revitalise communities by breathing new life into underused spaces.

Real estate debt in today’s market

In today’s low-yield environment, real estate debt stands out as a compelling investment option, offering:

- Risk-adjusted returns: Secured loans backed with tangible assets can provide attractive returns.

- Resilience: Real estate debt can provide greater downside protection than equity in uncertain economic conditions

- Impactful investment: Beyond financial benefits, these loans drive urban regeneration and deliver much-needed housing and infrastructure.

Creating long-term value

At Octopus, our mission is to unlock real estate value by financing projects that reposition and repurpose properties for the future. By focusing on liquid markets and prime locations and partnering with best-in-class developers, we ensure our investments target assets we believe have the greatest growth potential.

Transitional debt is not just a financial instrument – it’s a means to drive meaningful change, creating lasting value for investors, communities, and the environment.

Find out more

Explore our real estate debt strategy on our website.

Have a project in mind? Get in touch with our team by filling out the contact form below.

1 News on the Block – MPS urge Government to bring back quarter of million empty homes

2 Savills – Market in Minutes: City office market watch December 2024

3 GOV.UK – Housing targets increased to get Britain building again

4 Historic England – Heritage, Buildings & Embodied Carbon