Natural Capital Investment

Conservation and stewards of land to help solve the climate crisis.

Why invest in natural capital?

Investing in natural capital means focusing on the conservation of our landscapes, which includes planting trees, restoring peatland, and protecting biodiversity and local ecosystems. These activities create nature-based credits that we believe are integral in solving the climate crisis.

Decarbonisation is just one part of the puzzle to achieving net zero. Even with a path to removing emissions, there will always be residual hard-to-abate emissions that companies should be offsetting.

Growing numbers of companies have net zero targets not only because it’s the right thing to do, but because there are clear commercial advantages.

Demand for high quality nature-based credits is expected to increase in a market where the supply isn’t there yet.

Our latest report: Net Zero: The Second Stage

UK businesses are making progress towards net zero, but there’s still a long way to go.

Carbon credits – especially high-quality removal credits – are critical for tackling the hardest-to-abate emissions. However, knowledge gaps and mistrust in the market are slowing progress.

We surveyed over 300 UK business leaders to identify the biggest challenges and explore how nature can help rebuild confidence in the carbon credit market.

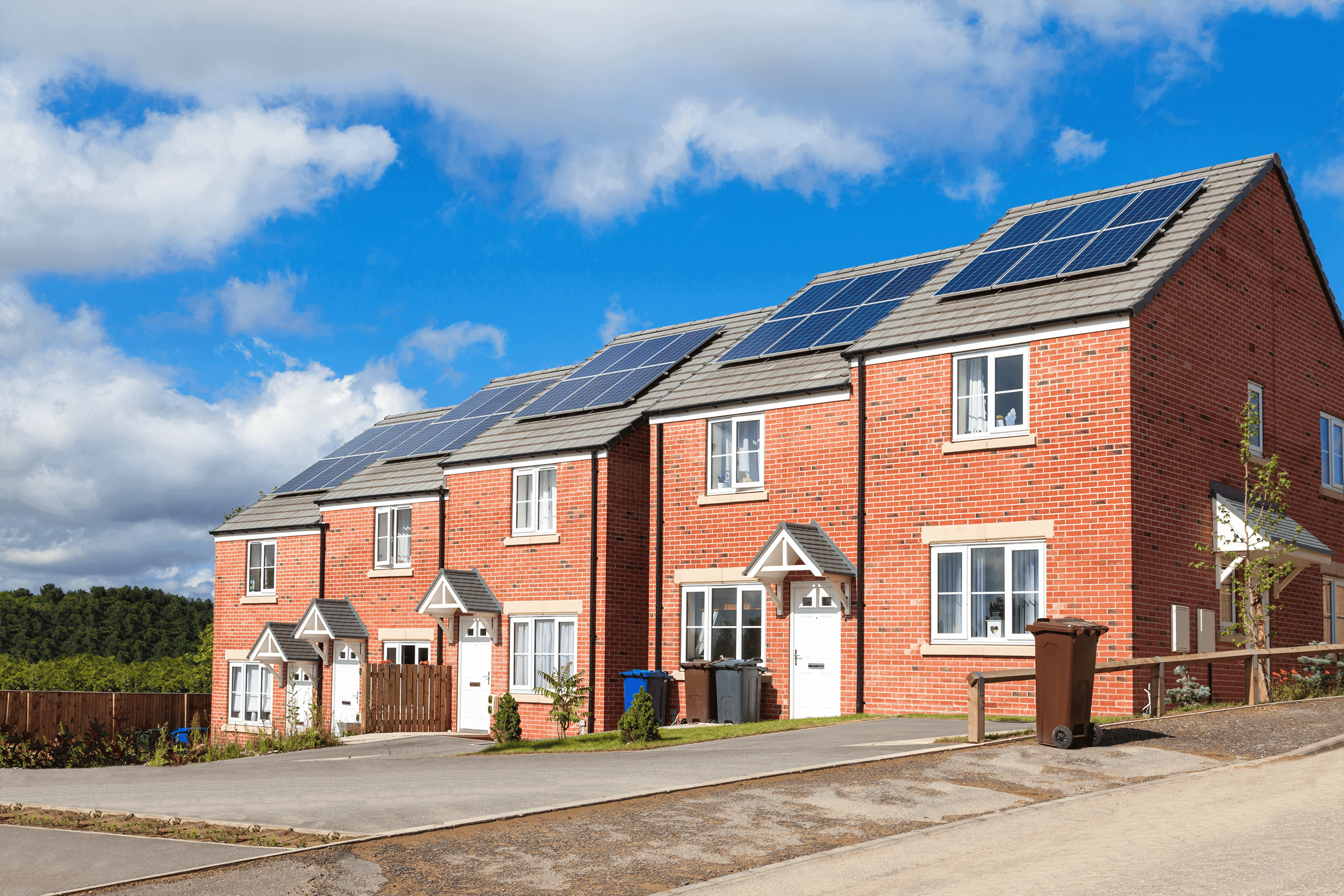

How we’re restoring the UK landscape

Watch our video to see how we’re generating trustworthy carbon credits through our robust investment management and high-quality conservation.

Our approach to natural capital investment

Companies need to offset their emissions authentically and avoid reputational risk. And investors need to invest in the responsible restoration and management of land.

We focus on carbon dioxide removal (CDR) activities which actually remove existing CO2 from the atmosphere and store it in natural carbon sinks for the long-term. Partnering with trusted operators to bring best-in-class conservation and rigorous investment management, we are creating real impact through the generation of high quality carbon credits that are worthy of trust.

Our holistic nature-based approach creates value for all stakeholders and helps investors capture the growth potential in the carbon market.

Trusted carbon credits

Produced by high-quality conservation and land management in the UK through bespoke intervention, locally sourced trees and species-rich woodlands, and a data-led approach.

Multiple layers of value creation

In addition to nature-based credits, targeting predictable and sustainable ancillary cash flows through property restoration, ecotourism, sustainable agriculture and renewable energy.

Community driven

Aligned with the needs of local communities, restoring the natural landscape, creating local jobs, providing open-access areas and avoiding planting on agricultural land.

“We have an opportunity to kickstart a natural capital economy. By focusing on the quality of conservation, investors can target attractive, sustainable returns and accelerate the transition to net zero.”

Jonathan Digges, Chief Investment Officer

Meet the team

Jonathan Digges

Michael Toft

Alex Godfrey

Gabi Slemer

Latest insights

Net Zero: The Second Stage – The need for quality in the carbon credit market

Octopus and Treeconomy announce the release of satellite-powered due diligence tool for nature-based carbon projects

Five key developments in 2025 for natural capital in the UK and beyond

Natural capital: a growing priority for responsible investors

Octopus & Treeconomy awarded UK Space Agency funding

We need to talk about carbon offsetting

Restoring the UK landscape to generate high-quality carbon credits

Octopus launches its natural capital strategy

In the news

Other investment capabilities

Real Estate

At Octopus, we’re committed to reimaging real estate investment. From seeing opportunities to bring institutional capital to emerging or underserved sectors, to our relentless focus on those living in the buildings we finance and manage.

Sustainable Infrastructure

We are investing in sustainable infrastructure, helping drive the transition to net zero.

Ventures

Octopus is home to one of Europe’s largest venture capital teams. We back early stage companies run by the world’s brightest minds.