Investing in preserving and restoring natural assets as a priority is gaining momentum.

While natural resources like oil, gas, agriculture, and forestry have always been part of investment portfolios, there’s often confusion between the traditional exploitation of natural resources and the growing focus on preserving and enhancing the environment.

The concept of safeguarding these resources is emerging as a critical and investable opportunity as environmental challenges like climate change and biodiversity loss push sustainability into the forefront of financial strategies.

But what exactly does natural capital mean for modern portfolios? And how can institutional investors make it work for them?

A new asset class with a clear purpose

The economy and nature are inextricably linked. Without healthy ecosystems, businesses that rely on natural resources face escalating costs, shrinking supplies, and increased volatility. The raw materials used in industries ranging from food to construction all stem from natural assets. As these resources deplete, the cost of doing business rises.

Take agriculture as an example: without investment in natural capital to rebuild the soils we have destroyed through industrial agriculture, even everyday items like strawberries could become luxuries instead of something we nonchalantly top our porridge with every morning. The future of any business is tied to the health of the natural systems it depends on.

Natural capital represents the value derived from nature, encompassing services like clean water, food production, carbon sequestration, and biodiversity. As nature faces growing pressure from human activity, these services become more valuable—and investors are taking notice.

These services, often called ecosystem services, have long been taken for granted, but their degradation threatens the availability of essential resources and increases their costs.

Restoring nature, however, is a monumental task, and the only way to achieve it at scale is by mobilising institutional capital. For investors, monetising these ecosystem services can create an opportunity to participate in a market that offers both financial returns and significant environmental impact.

The value of natural capital

For years, we’ve treated nature as an endless resource, assuming its services—like purifying air and water—would always be free. That assumption has led to crises such as climate change and biodiversity loss.

Human activity has caused degradation across ecosystems, bringing us closer to a potential tipping point. The World Economic Forum estimates that more than half of global GDP depends on nature, with $44 trillion of economic value at risk due to nature loss. Other sources have suggested similar numbers, valuing ecosystem services to humanity in the tens of trillions of dollars per year.

As nature’s deterioration becomes more evident, it poses an undeniable threat to long-term portfolio values.

The challenge, then, is how to capture the value of these natural services. And while difficult, it’s possible. Ecosystem services—whether it’s forests absorbing carbon, wetlands filtering water, or soil supporting food production—can be measured and monetised.

These deeper green natural capital investments go beyond simply investing in natural resources and towards conservating and improving them. They enable investors to protect the planet and secure long-term portfolio value by mitigating risks associated with environmental degradation.

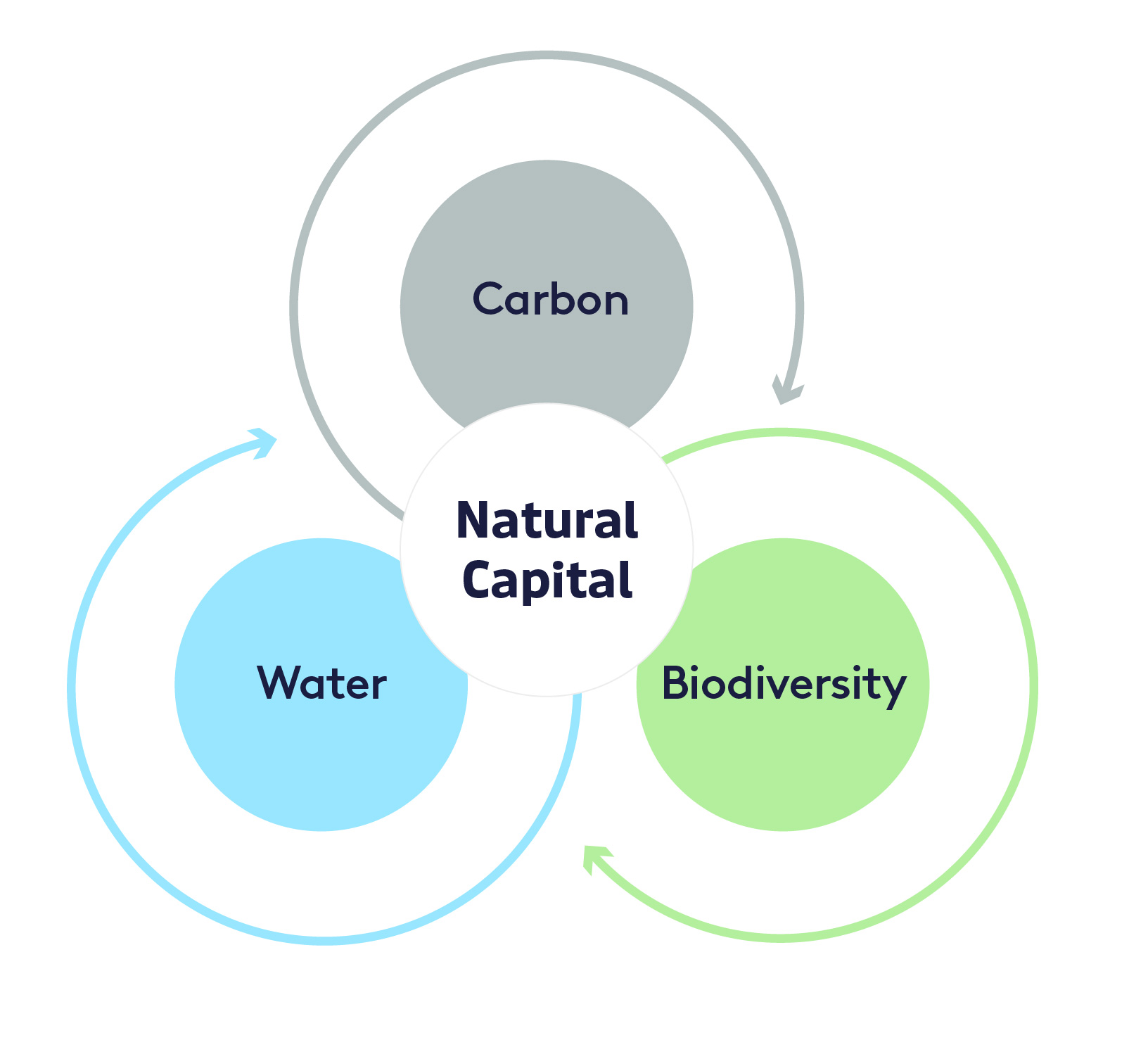

The three pillars of natural capital

At Octopus, our approach to natural capital focuses on being responsible stewards of land. We believe it’s important to take a nature-first approach and consider three interconnected pillars: carbon, biodiversity, and water when thinking about land restoration.

These are essential to all life on Earth—and, therefore, the global economy. By viewing these natural assets through an economic lens, we aim to capture the value they provide and support their restoration and preservation.

Carbon is currently the most developed and investable aspect of these three pillars, largely due to global net zero commitments. With many governments and businesses striving for net zero by 2050, the market for carbon credits—generated through activities like afforestation or peatland restoration—is maturing.

Decarbonisation alone won’t get us to net zero. The last 10% of emissions that are hard to abate will need to be offset using solutions like carbon credits. This is a key factor driving the current demand for carbon credits.

More credits to come

While carbon is currently the most developed and investable pillar, the future of natural capital investing extends beyond just carbon credits. Biodiversity and water credits, for example, are gaining traction as global priorities shift toward restoring ecosystems and managing resources more sustainably.

We can expect new markets for environmental credits to emerge in the coming years, driven by increasing regulation, corporate sustainability commitments, and the recognition of natural ecosystems’ intrinsic value. Biodiversity credits, for instance, are poised to play a crucial role in protecting species and habitats, while water credits may offer solutions for managing this critical and increasingly scarce resource.

The evolution of these credits can be seen as a natural progression, providing investors with further opportunities to support the environment while targeting meaningful financial returns. By diversifying our approach to natural capital, we aim to capture the full spectrum of benefits that responsible land stewardship can provide—from carbon to biodiversity and beyond.

Why invest in natural capital?

The reasons to invest in natural capital are becoming more and more apparent.

Climate change, biodiversity loss, and resource scarcity are creating challenges for global economies, and natural capital offers a pathway to both financial returns and environmental resilience.

For institutional investors, the appeal lies in the opportunity to generate returns while addressing the most pressing environmental challenges of our time. Two main reasons include:

- Hedging against carbon credit price increases, which are likely to drive down the value of other investments.

- Offsetting their own environmental footprint as part of sustainability and net-zero commitments.

If the market’s supply and demand fundamentals continue to increase, attractive returns are possible for those willing to accept the associated risks of investing in a nascent market. Natural capital is a growing asset class, and early investors could benefit from rising demand, increased regulation, and mounting pressure on companies to meet net-zero commitments.

The Octopus approach: integrity, impact, and financial merit

At Octopus, we believe natural capital investments should be valued not only for their environmental impact but also for their financial returns.

Our strategy focuses on maximising land potential through best-in-class land stewardship that generates both nature credits (such as carbon or biodiversity credits) and other revenue streams, such as ecotourism, renewables, regenerative agriculture, and property.

If you’re interested in exploring how natural capital can fit into your portfolio, we’d love to talk.

Contact us below to join the conservation.

Investments in natural capital assets can be high risk.

Investors may not get back the full amount they invest.

Interested in Natural Capital?

Talk to one of us.

If you are interested in investing into Natural Capital, we would love to hear from you.

Please fill out the form below and we will be in touch shortly to arrange a time for further discussion.